Though I can’t really play, I like to say that I think guitar. This probably makes no sense to you. Think of it this way: Everyone (or I hope everyone) has an instrument that really speaks to them. It makes a sound that connects you to something nonverbal, something primal. Mine is guitar. So when Dan Rosenberg, a guitarist friend of mine in college, introduced me to improvisational jazz, it was mind altering. When you hear really good jazz musicians improvising, it’s like enjoying a fascinating, long story with familiar and unfamiliar parts but without any anxiety about how it might end. It is the art of joyous uncertainty. Dan taught me that there are three pillars of jazz improv:

1) Define the sandbox

2) Connect the chords

3) Articulate your lines

“Define the sandbox” means understanding what set of notes and scales you have to play within. “Connect the chords” literally means connecting the last note played to the first chord. The last one is the most sophisticated and hardest to explain as a non-musician: articulate your lines. It’s the ability to start/end musical phrases anywhere within the form. I imagine it like being able to fly outside the sandbox for a few laps only to return with a perfect landing. Line articulating is what distinguishes good from great players in the world of jazz music.

Q1 market reports come out this week and there’s bubble talk happening again. Queue the helium tank hissing sound. I don’t know about you but so far 2022 feels just as bananas as last year. It doesn’t seem possible when you look at the numbers, though. This NY Times headline captures it well: “Can Home Prices and Interest Rates Soar at the Same Time?” Yes, indeed they can, as evidenced by the following:

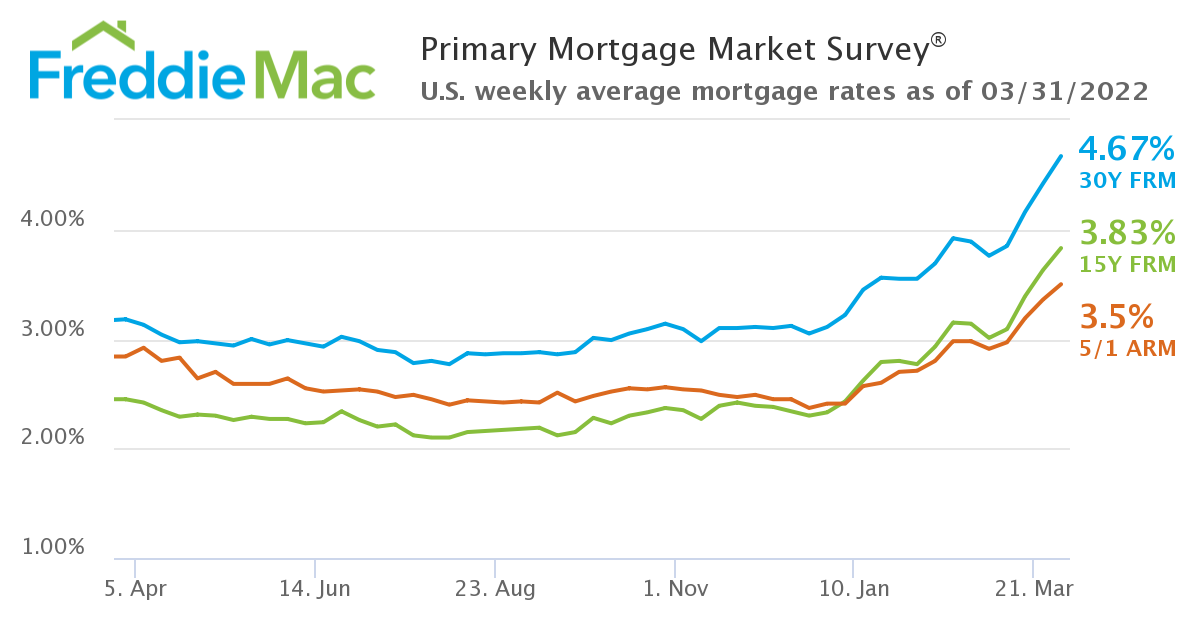

Credit: Freddie Mac

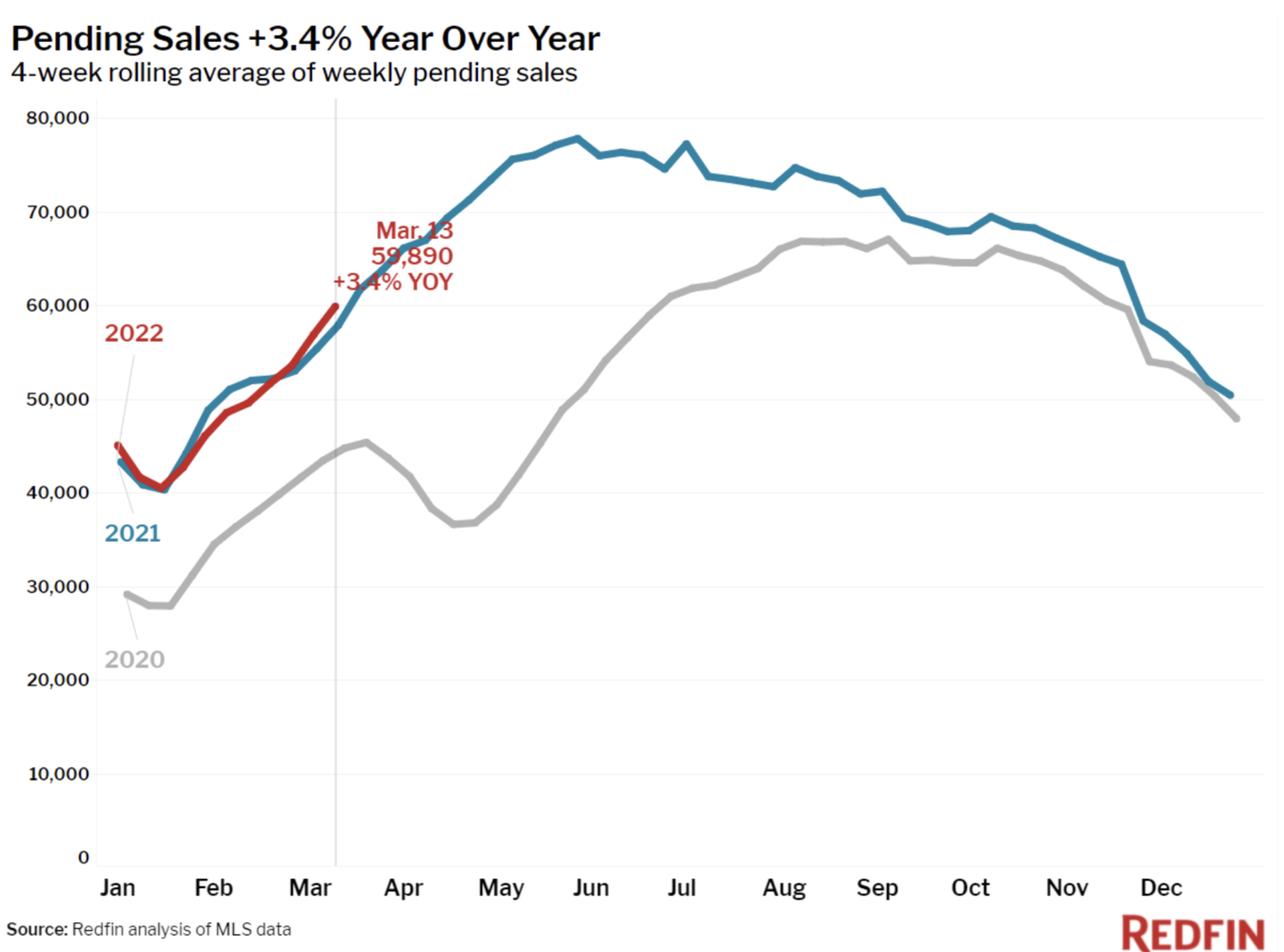

Credit: Redfin

In the last month we have seen mortgage interest rates climb from 3.89% to 4.67% and a 3% jump in new contracts, according to Redfin. Historically, climbing mortgage rates have had the effect of cooling off rising housing prices. But that’s in a “normal” market and there’s nothing normal or typical about what we are seeing right now. It’s the confluence of a number of unique factors: the millennials have come of age and the boomers are staying put longer; there has been slow growth in home building over the last decade; historically low interest rates; remote work relocation expansion; and expectations-driven explosive appreciation (often referred to as exuberance or “irrational exuberance”).

Prices have gone up so rapidly in the last two years that many buyers are being driven by the fear of missing out.

Investopedia defines “irrational exuberance” as “widespread and undue economic optimism. When investors start believing that the rise in prices in the recent past predicts the future, they are acting as if there is no uncertainty in the market, causing a positive feedback loop of ever-higher prices.” This is a new one for me, irrational exuberance. It aptly describes the mood right now in the housing market. Prices have gone up so rapidly in the last two years that many buyers are being driven by the fear of missing out. FOMO is a powerful force. Even at the tip pointing of unaffordability, there is still so much demand. There’s a nationwide home buying party going on and the price of entry is getting steeper and steeper. Remember when the vaccine first came out and many were predicting that the summer of 2021 would be the start of a period like the roaring twenties? Everyone was dying to party, itching to travel, excited to ditch their sweatpants for something else, anything else. Well, Delta made sure that there was more moaning than roaring but there were still houses to buy and apartments to rent so the housing party continued. As far as cultural revolution and emerging trends, it’s hard to say where we are right now, almost a year later. (If we don’t stop talking about Will Smith’s slap soon, then I would argue we are at a low point).

The 1920s was a decade of prosperity, prohibition and women’s rights. It saw the dawn of television and the first solo transatlantic flight. It was also the jazz age. That’s right, here I go again, bringing back jazz. Indulge me, for a beat, because maybe in the face of “irrational exuberance” and a wildly unpredictable housing market we ought to be thinking more about jazz.

There is much to learn from the pillars of improvisation. For instance, where are the longitudinal lines of your sandbox? Where is your sweet spot market wise? Are you connecting the chords? This is essential to keep the rhythm going. In our business we call it momentum. Are you leveraging that contract, that closed sale to connect A to B? There’s a story to tell. It’s that postcard you have been meaning to send. Don’t drop the ball. You’ll break the tune. And the illustrious line articulation—how willing and able are you to draw your own line, to venture outside of the sandbox and create something new? Perhaps the only way to operate in this wonky market is to improvise, to be joyous in uncertainty, and to not worry about how it might end. Enjoy the ride and get it while the getting is good.

Until next week,

![]()