At this point you’ve probably compared the benefits of buying vs renting, and you’ve chosen to buy your first NYC apartment! As one of the most exciting and diverse real estate markets in the world, NYC can be a thrilling but daunting (and not to mention expensive) place to begin your home-buying journey. That’s why we’ve put together this comprehensive guide for first-time homebuyers to help you navigate the process with enthusiasm, confidence and ease.

From defining your budget to closing the deal, we’ve got you covered. So, let’s dive in and start exploring the ins and outs of buying an apartment in the Big Apple so you don’t make costly mistakes!

Tip 1: Define your budget and stick to it

Buying an apartment in NYC can be an exciting and overwhelming experience, especially if it’s your first time. To make the process easier, it’s important to define your budget and stick to it. By doing so, you’ll avoid the stress and disappointment of falling in love with an apartment that’s outside of your price range.

To determine a realistic budget, start by analyzing your finances and calculating how much you can afford to spend on a monthly mortgage payment. A mortgage broker should be able to help you understand the size of mortgage that you can qualify for during the mortgage pre approval process. Your mortgage amount plus your expected down payment will determine your budget. Be sure to consider other expenses as well, such as utilities, property taxes and maintenance fees. It’s also helpful to research typical costs for these expenses in the area where you’re considering buying.

Once you have a budget in mind, stick to it. Consider working with a real estate agent who understands your budget constraints and can show you properties within your price range. Remember that going over budget can have long-term consequences, such as higher monthly payments and increased debt. By defining your budget and sticking to it, you’ll be setting yourself up for long-term financial stability.

Tip 2: Research neighborhoods

When it comes to buying your first NYC apartment, choosing the right neighborhood is just as important as finding the right apartment. Before you start your search, take some time to research different neighborhoods and find one that aligns with your lifestyle and budget. Are you looking for a quiet, family-friendly area or a bustling, nightlife-filled neighborhood? Do you want to be close to parks and green spaces or do you prefer a more urban feel? Do you need to be close to a certain subway station or bus line?

To research neighborhoods, start by using online resources such as neighborhood guides and review sites. These can give you a good idea of the different amenities, restaurants and attractions that each neighborhood has to offer. You can also visit the websites of local neighborhood newspapers, such as West Side Rag for the Upper West Side or Tribeca Citizen for Tribeca, or guides from websites such as The Infatuation and Eater for the foodie crowd. It’s also important to visit neighborhoods in person to get a feel for the atmosphere and community. Walk around, visit local shops and restaurants, and talk to locals to get a sense of what it’s really like to live there.

Once you’ve narrowed down your list of potential neighborhoods, make sure to factor in the cost of living in each area when determining your budget. Prices can vary widely between neighborhoods, so it’s important to be realistic about what you can afford in the areas that interest you. By doing your research upfront, you can make sure you find a neighborhood that you love and that fits within your budget.

Hot Tip: When purchasing your first NYC apartment, consider both your monthly mortgage payments, as well as the monthly building maintenance charges. This Manhattan property listed at 142 East 71st Street in Manhattan asks $499,000 and has additional monthly building maintenance charges of $1,803/mo.

Tip 3: Hire a reputable real estate agent

Buying your first NYC apartment can be overwhelming, which is why it’s important to work with a reputable real estate agent. They can offer valuable guidance throughout the entire process, from identifying suitable properties to negotiating a deal.

When searching for an agent, start by checking their credentials and references. Look for someone who is experienced in working with first-time homebuyers in NYC and who has a strong track record of successful transactions. You should also choose an agent who communicates clearly and regularly, keeping you informed throughout the buying process. With the right agent, you can make informed decisions and avoid common pitfalls in the NYC real estate market.

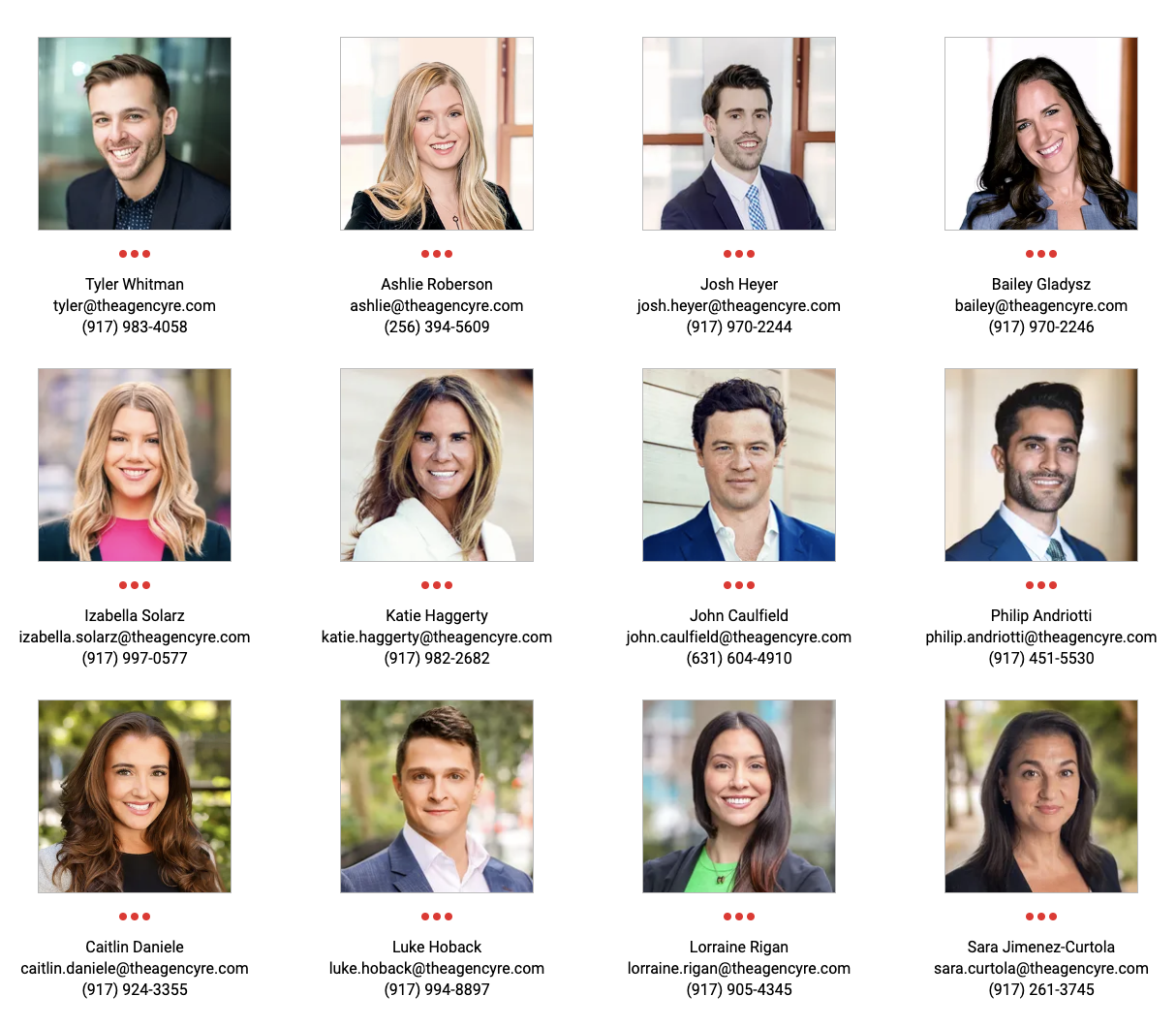

At The Agency, we pride ourselves on providing top-notch service and expertise to our clients. Our agents are highly experienced and knowledgeable about the NYC real estate market, and they work tirelessly to help our clients find their dream home. With access to our extensive network and resources, our agents are equipped to handle any challenge that may arise during the buying process. Plus, our commitment to fair housing practices ensures that every client is treated with respect and fairness. If you’re ready to start your journey to finding your first NYC apartment, contact us today and let us help you make your dream a reality.

Tip 4: Get pre-approved for a mortgage

Before starting your search for your first NYC apartment purchase, it’s essential to get pre-approved for a mortgage. This not only helps you understand your budget better but also makes you a more attractive buyer to sellers. With the highly competitive nature of the NYC housing market, a pre-approval can give you a significant advantage over other potential buyers. When it comes to finding a reputable lender, it’s best to do your research and compare rates and terms from different lenders. You can start by checking with your bank or credit union, but don’t be afraid to shop around for better options. Once you’ve found a few lenders, request pre-approval for a mortgage.

Banks will often offer discounted rates to clients who have their money at the bank, sometimes as much as 0.5% off the market rate.

Keep in mind that pre-approvals are based on a thorough evaluation of your financial history, credit score and employment status, so make sure you have all of the necessary documents and information readily available. Getting pre-approved may take some time, but it’s worth it in the end. By doing so, you’ll have a better idea of what you can afford, which will make your apartment hunt much more efficient and productive.

Tip 5: Make a checklist of your must-haves

Having a clear idea of what you want in an apartment can help streamline the process of buying your first NYC apartment. That’s where making a checklist of must-haves comes in handy. By identifying your non-negotiables and deal breakers, you can focus your search on properties that meet your criteria and avoid wasting time on apartments that don’t.

When creating your checklist, think about the features that are most important to you. Do you need a specific number of bedrooms or bathrooms? Do you require outdoor space or a specific location? Would you prefer a doorman building or a walk-up? Once you’ve identified your must-haves, consider your deal breakers. Are there any features or issues that would make an apartment a no-go for you? In NYC, it’s also important to consider what building type is right for you. For example, co-ops make up a large percentage of the inventory – and have unique sets of rules to be considered when purchasing in a co-op building.

Having a clear and concise checklist can also help you communicate your needs to your real estate agent, making the search process more efficient and effective. So take the time to make a checklist of your must-haves and deal breakers before beginning your search for your first NYC apartment.

Tip 6: Attend open houses and schedule private showings

Buying an apartment in NYC is a significant investment, so it’s essential to see as many properties as possible before making a decision. Attending open houses and scheduling private showings are great ways to see a variety of apartments in different neighborhoods.

By attending open houses, you can get a feel for different buildings and neighborhoods without committing to a private showing. This can help you narrow down your search and save time in the long run. It can also be helpful for getting a sense of the demand for that type of apartment; a very busy open house might be a good indicator that this apartment will sell quickly. When attending an open house, be sure to take note of the condition of the apartment, the building amenities and any potential drawbacks.

Private showings offer more flexibility and the opportunity to ask questions and explore the space in more detail. It’s essential to come prepared with a list of questions and to take note of any issues or concerns you may have. Additionally, try to schedule showings during different times of the day to see how natural light and noise levels vary.

When looking at apartments, it’s important to keep your checklist of must-haves and deal breakers in mind. Pay attention to the details that matter most to you, whether it’s a particular view, the amount of natural light, or proximity to public transportation.

By attending open houses and scheduling private showings, you can get a better sense of the market and make a more informed decision when it comes time to make an offer.

Hot Tip: Not all agents are created equally. The not-so-secret-sauce of The Agency’s success is our boutique approach – meaning we only hire the brightest, most qualified agents to service our Buyers and Sellers. Call (866) 371-6468 to get matched with the best agent for your search or sale.

Tip 7: Ask the right questions

When buying an apartment, it’s essential to ask the right questions to ensure that you’re making an informed decision. Asking the right questions will help you avoid potential issues and ensure that you find an apartment that meets your needs.

First and foremost, ask about the building rules and regulations, such as any pet policies, noise restrictions or sublet policies. These rules can significantly impact your living experience, so it’s important to have a clear understanding of them before making an offer. Other questions to ask include the age of the building, the condition of the apartment, any recent renovations and the building’s maintenance and repair history. Additionally, ask about the neighborhood, such as local amenities, safety and transportation options.

By asking the right questions, you can make a more informed decision when buying your first NYC apartment. Don’t be afraid to ask questions, as this can help you avoid any surprises down the line.

Tip 8: Don’t rush the process

With so many options and factors to consider when buying your first NYC apartment, it’s important not to rush into a decision. Taking your time and carefully considering your options can save you from regretting your purchase later on. One of the biggest mistakes first-time buyers make is feeling pressured to make a decision quickly. While it’s understandable to want to get settled into your new home as soon as possible, rushing the process can lead to overlooking important details and settling for a property that doesn’t meet your needs.

To avoid making a hasty decision, consider making a list of must-haves and deal-breakers before you begin your search. This will help you stay focused and ensure that the properties you’re considering meet your most important criteria. It’s also important to view multiple properties and attend open houses to get a better sense of what’s available in your budget and preferred neighborhoods.

Remember, buying a home is a major investment and decision that shouldn’t be taken lightly. Don’t feel pressured to make an offer on the first property you see. Take your time, weigh your options and wait for the right property that meets your needs and budget.

Tip 9: Make a strong offer

When you finally find the right property, it’s important to make a strong offer to increase your chances of success. Making a competitive offer can be the key to securing your dream home. First, ensure that you are pre-approved for a mortgage so that you can act quickly. Additionally, consider offering a quick closing to show that you are serious about buying the property.

Remember, a strong offer does not necessarily mean offering more money than the asking price. Sometimes other factors like the terms of the deal or a larger down payment can make your offer more appealing to the seller. Ultimately, working with your real estate agent and carefully assessing the market can help you make a strong and strategic offer.

Tip 10: Hire a real estate attorney

Buying a NYC apartment is a major investment, so it’s important to have the right legal representation during the process. Hiring a real estate attorney can help ensure that your interests are protected and that the transaction goes smoothly. A real estate attorney can review the purchase agreement, negotiate the terms of the contract and provide guidance on any legal issues that may arise. If you’re purchasing in a large apartment building, the attorney will also assist with diligence on the building by working with the management company to review the building’s financials and board meeting minutes.

When looking for a real estate attorney, it’s important to choose someone who specializes in real estate law and has experience with NYC property transactions. Referrals from friends or family can be a good starting point, but do your own research and check the attorney’s credentials and track record. The Agency is happy to provide recommendations for experienced real estate attorneys. Once you’ve chosen an attorney, they will work with you to review the contract and ensure that your interests are represented throughout the process.

Keep in mind that working with a real estate attorney is an additional expense, but it’s a small price to pay for the peace of mind that comes with knowing that your investment is protected. By taking the time to find a reputable attorney, you can feel confident that you’re making a sound investment in your future.

Buying your first NYC apartment can be an overwhelming process, but with the right approach, it can be an exciting and rewarding experience. By following the ten tips discussed in this guide, you’ll be better equipped to find the right property, secure financing, and navigate the legal process. Remember to take your time, do your research and work with trusted professionals, including a reputable real estate agent and attorney. With the right preparation and patience, you’ll soon be on your way to finding the perfect home in the Big Apple. We hope that these tips serve as a useful guide for your first-time apartment buying experience.

You can get started with the process by searching apartment listings on TheAgencyRE.com or reaching out to our team for an introduction to a buyer’s agent and first-time homebuyer specialist.